In today’s unpredictable world, financial security for your family extends beyond basic life coverage. The newly launched Aditya Birla Sun Life Insurance Super Term Plan addresses this need by combining robust life insurance with critical illness protection and income replacement benefits—all in one comprehensive package. This innovative plan ensures your loved ones remain financially secure, not just in your absence, but also during health emergencies that could impact your earning capacity.

Understanding the ABSLI Super Term Plan

The Aditya Birla Sun Life Insurance Super Term Plan is a non-linked, non-participating individual pure risk premium life insurance plan designed to provide comprehensive financial protection. Unlike traditional term insurance that focuses solely on death benefits, this plan offers a three-dimensional shield covering life, health, and income protection.

Why Traditional Term Plans May Not Be Enough

Standard term insurance plans typically offer death benefits only, leaving families vulnerable to other financial risks such as:

- Loss of income due to critical illness

- Financial burden of medical treatments

- Inability to maintain lifestyle during health crises

- Lack of flexibility in benefit payouts

The ABSLI Super Term Plan addresses these gaps by providing a comprehensive solution that safeguards against multiple life uncertainties.

Plan at a Glance

- UIN: 109N153V01

- Coverage up to age 85

- Minimum Sum Assured: ₹25,00,000

- Premium starting at ₹517/month

- Multiple premium payment options

- Three flexible plan options

Key Features of the ABSLI Super Term Plan

The Super Term Plan stands out in the crowded insurance market with its unique combination of features designed to provide holistic protection for you and your family.

Life Coverage Protection

Secure your family’s financial future with substantial life coverage that provides a safety net in your absence.

- High sum assured starting from ₹25 lakhs with no upper limit

- Coverage available up to 85 years of age

- Flexible death benefit payout options: lumpsum, monthly income, or both

Health Protection Benefits

Stay financially protected against health emergencies with comprehensive critical illness coverage.

- Terminal illness benefit with early payout

- Accelerated Critical Illness (ACI) benefit covering major illnesses

- Waiver of Premium on Accidental Total and Permanent Disability (ATPD)

Income Replacement Features

Ensure your family maintains their lifestyle with flexible income replacement options.

- Staggered Death Benefit for regular income flow

- Commutation of Income Benefit for flexibility

- Option to defer premiums with Cover Continuance Benefit

Not Sure How Much Coverage You Need?

Use our online calculator to determine the ideal coverage amount based on your income, liabilities, and family needs.

Flexible Plan Options to Suit Your Needs

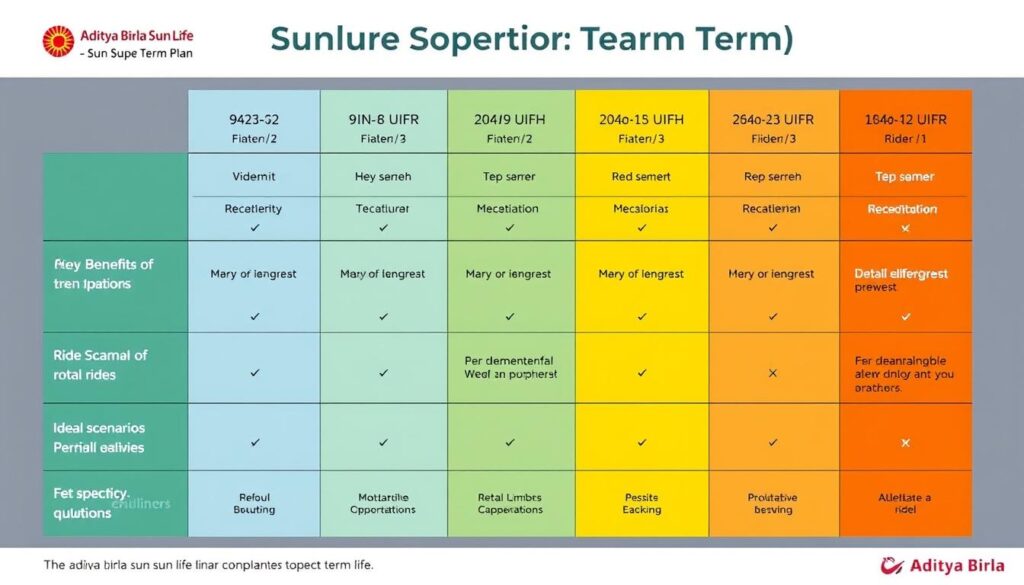

The ABSLI Super Term Plan offers three distinct options, allowing you to choose the protection that best aligns with your financial goals and family requirements.

| Plan Option | Key Features | Ideal For |

| Option 1: Level Cover | Fixed sum assured throughout the policy term with death benefit paid as chosen payout option | Individuals seeking consistent, reliable coverage with affordable premiums |

| Option 2: Increasing Cover | Sum assured increases by 10% of base sum assured every 5 years (up to 50% increase) | Young professionals expecting income growth and increasing financial responsibilities |

| Option 3: Level Cover with Return of Premium | Fixed sum assured with return of all premiums paid if you survive the policy term | Those who want protection with the benefit of premium return at maturity |

Death Benefit Payout Options

The ABSLI Super Term Plan offers flexible payout options to ensure your family receives financial support in the most suitable manner:

- Lumpsum: Entire sum assured paid at once to address immediate financial needs

- Monthly Income: Regular monthly payments to replace income and maintain lifestyle

- Lumpsum + Monthly Income: Combination of both to balance immediate and ongoing needs

Enhanced Life Stage Protection

The plan allows you to increase your sum assured at key life milestones without additional medical tests:

- Marriage (increase by 50% of original sum assured)

- Birth/adoption of child (increase by 25% of original sum assured)

- Home purchase (increase by 25% of original sum assured)

Maximum increase allowed: 100% of original sum assured

Explore Plan Options in Detail

Learn more about each plan option and find the perfect fit for your protection needs.

Comprehensive Health Protection Features

The ABSLI Super Term Plan goes beyond traditional term insurance by incorporating robust health protection features that provide financial security during critical health situations.

Terminal Illness Benefit

If you’re diagnosed with a terminal illness with a life expectancy of six months or less, the plan provides an early payout of the death benefit. This helps cover treatment costs and financial obligations during this difficult time.

Benefit: 100% of sum assured paid in advance

Accelerated Critical Illness Benefit

The plan offers coverage against major critical illnesses, providing a lumpsum payout upon diagnosis to help manage treatment expenses without depleting your savings.

Coverage: Up to 42 critical illnesses including cancer, heart attack, and kidney failure

Waiver of Premium on ATPD

If you suffer from Accidental Total and Permanent Disability, all future premiums are waived while your policy coverage continues, ensuring your family remains protected even when you can’t pay premiums.

Age limit: Available for life insured up to 70 years

“The ABSLI Super Term Plan’s health protection features address a critical gap in traditional term insurance by providing financial support not just after death, but also during health crises when financial needs are often at their peak.”

Income Protection and Financial Flexibility

The ABSLI Super Term Plan offers innovative features designed to ensure income continuity and financial flexibility for your family.

Staggered Death Benefit

This feature allows your nominee to receive the death benefit as regular monthly installments rather than a lumpsum amount. This helps in:

- Replacing your monthly income for family expenses

- Ensuring disciplined fund management

- Providing long-term financial stability

The monthly installments can be structured over a period of your choice, helping your family maintain their lifestyle without the burden of managing a large lumpsum amount.

Commutation of Income Benefit

This flexible feature allows your nominee to convert future monthly income payments into an immediate lumpsum amount if needed. This provides:

- Flexibility to address urgent financial needs

- Option to invest the amount as per changing requirements

- Adaptability to evolving financial circumstances

The commutation option ensures your family can access funds when they need them most, without being restricted by the original payout structure.

Cover Continuance Benefit

The ABSLI Super Term Plan includes a unique Cover Continuance Benefit that allows you to defer premium payments for up to 12 months during financial difficulties, while keeping your policy active. This feature can be used:

- Up to three times during the policy term

- With a minimum gap of 5 years between each deferment

- Without any impact on your policy benefits

This ensures your family remains protected even during temporary financial setbacks.

Learn About Premium Payment Options

Discover flexible premium payment modes and terms to suit your financial planning.

Enhance Your Protection with Additional Riders

The ABSLI Super Term Plan can be further customized with optional riders to create a truly comprehensive protection solution tailored to your specific needs.

ABSLI Accidental Death and Disability Rider

UIN: 109B018V03

Provides an additional sum assured in case of accidental death or disability, enhancing your family’s financial protection against unexpected events.

Benefit: 100% of rider sum assured paid as lumpsum

ABSLI Critical Illness Rider

UIN: 109B019V03

Offers a lumpsum benefit upon diagnosis of specified critical illnesses, helping cover treatment costs and manage expenses during recovery.

Condition: Survival period of 30 days from diagnosis

ABSLI Surgical Care Rider

UIN: 109B015V03

Provides financial support for surgical procedures, reducing the burden of medical expenses during hospitalization.

Requirement: Minimum 24-hour hospitalization for covered surgeries

ABSLI Hospital Care Rider

UIN: 109B016V03

Offers daily cash benefit during hospitalization, helping manage routine hospital expenses without depleting your savings.

Coverage: Daily benefit plus additional ICU benefit

ABSLI Accidental Death Benefit Rider Plus

UIN: 109B023V02

Provides enhanced protection with additional sum assured and refund of premiums collected after the accident date in case of accidental death.

Extra benefit: Refund of premiums with interest

ABSLI Waiver of Premium

UIN: 109B017V03

Waives all future premiums in case of critical illness or disability, ensuring policy benefits continue even when you’re unable to pay premiums.

Coverage: Base plan and attached riders

Customize Your Protection Plan

Speak with an ABSLI advisor to create a personalized protection plan with the right combination of riders.

Tax Benefits of ABSLI Super Term Plan

The ABSLI Super Term Plan offers significant tax advantages that enhance its overall value proposition.

Premium Payment Tax Benefits

Under Section 80C of the Income Tax Act, 1961, you can claim tax deductions on premiums paid towards the ABSLI Super Term Plan:

- Deduction limit of up to ₹1.5 lakhs per financial year

- Applicable for premiums paid for self, spouse, and dependent children

- Helps reduce your taxable income and overall tax liability

This tax benefit makes the plan even more cost-effective, effectively reducing the net cost of your comprehensive protection.

Death Benefit Tax Exemption

Under Section 10(10D) of the Income Tax Act, 1961, the death benefit received by your nominee is generally tax-exempt:

- Complete tax exemption on the sum assured paid out as death benefit

- Applicable to lumpsum payouts as well as monthly income options

- Ensures your family receives the full benefit amount without tax deductions

This tax exemption maximizes the financial support available to your family when they need it most.

Important Note: Tax benefits are subject to changes in tax laws. Please consult your tax advisor for detailed and updated information on tax implications. The Section 10(10D) benefit is available subject to fulfillment of conditions specified therein.

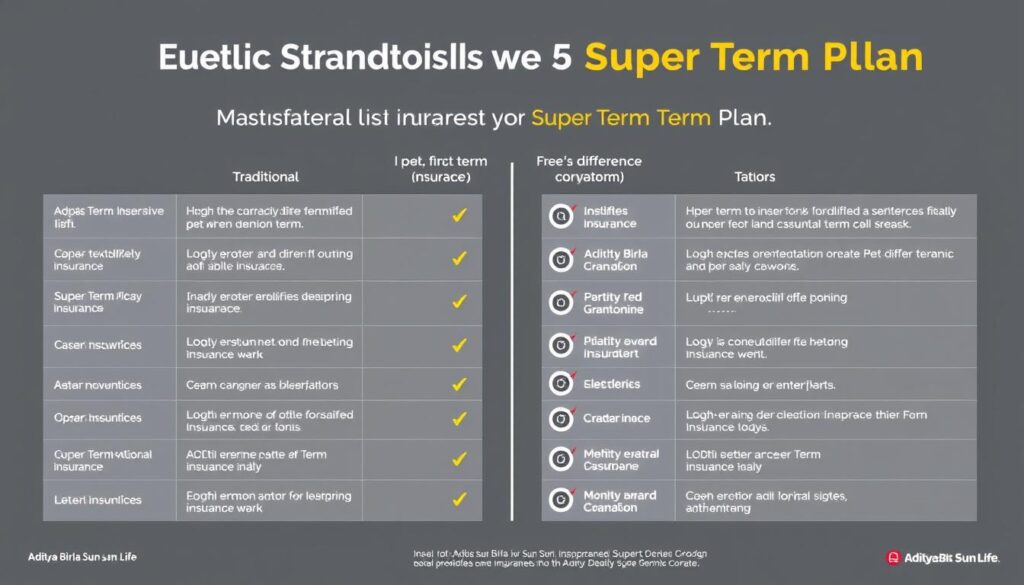

How ABSLI Super Term Plan Compares to Traditional Term Insurance

The ABSLI Super Term Plan offers several advantages over traditional term insurance plans, making it a more comprehensive protection solution.

| Feature | Traditional Term Insurance | ABSLI Super Term Plan |

| Protection Coverage | Life coverage only | Life, health, and income protection |

| Health Benefits | Usually available only as riders | Inbuilt terminal illness and disability benefits |

| Payout Options | Limited flexibility | Multiple options: lumpsum, income, or combination |

| Premium Flexibility | Standard payment terms | Cover Continuance Benefit for premium deferment |

| Return of Premium | Rarely available | Available as a plan option |

| Life Stage Adjustments | Limited or unavailable | Enhanced Life Stage Protection feature |

Advantages of ABSLI Super Term Plan

- Comprehensive 3-in-1 protection (life, health, income)

- Flexible plan options to suit different needs

- Inbuilt health benefits without additional rider costs

- Premium payment flexibility during financial difficulties

- Special discounts for salaried individuals and women

- Option to increase coverage at key life stages

Limitations to Consider

- Higher premium than basic term plans due to additional benefits

- Terminal illness benefit available only up to age 80

- Early Exit Value available only under specific conditions

- Suicide exclusion applies for first 12 months of policy

Simplified Claim Process

The ABSLI Super Term Plan features a streamlined claim process designed to provide quick financial support to your family when they need it most.

Step 1: Claim Intimation

Your nominee can initiate the claim process by:

- Filling basic details online

- Calling the toll-free helpline

- Visiting the nearest ABSLI branch

Early intimation helps expedite the claim settlement process.

Step 2: Document Submission

Required documents include:

- Completed claim form

- Original policy document

- Death certificate

- ID proof of nominee

- Bank account details for direct transfer

Digital submission options are available for convenience.

Step 3: Claim Settlement

Once all documents are verified:

- Claim amount is processed as per the chosen payout option

- Direct transfer to nominee’s bank account

- Regular follow-ups and updates on claim status

ABSLI’s high claim settlement ratio ensures reliable support.

Learn More About Our Claim Process

Discover how ABSLI ensures a smooth and hassle-free claim experience for your loved ones.

Frequently Asked Questions

Get answers to common questions about the ABSLI Super Term Plan and its features.

What makes the ABSLI Super Term Plan different from other term insurance plans?

The ABSLI Super Term Plan stands out with its comprehensive 3-in-1 protection approach, covering life, health, and income security. Unlike traditional term plans that focus solely on death benefits, this plan includes inbuilt terminal illness benefits, disability protection, and flexible payout options. It also offers unique features like Cover Continuance Benefit for premium deferment and Enhanced Life Stage Protection to increase coverage at key life events without medical tests.

Can I customize the death benefit payout for my family’s needs?

Absolutely! The ABSLI Super Term Plan offers flexible payout options to suit your family’s financial requirements. You can choose between a lumpsum payment to address immediate needs, monthly income to replace your regular earnings, or a combination of both. Additionally, the Commutation of Income Benefit allows your nominee to convert future monthly payments into a lumpsum amount if their financial situation changes, providing true flexibility when it matters most.

What happens if I’m unable to pay premiums during a financial emergency?

The ABSLI Super Term Plan includes a unique Cover Continuance Benefit that allows you to defer premium payments for up to 12 months during financial difficulties, while keeping your policy active. This feature can be used up to three times during the policy term with a minimum gap of 5 years between each deferment. This ensures your family remains protected even during temporary financial setbacks, providing peace of mind when you need it most.

What tax benefits are available with the ABSLI Super Term Plan?

The ABSLI Super Term Plan offers dual tax advantages. Premiums paid are eligible for tax deductions under Section 80C of the Income Tax Act, 1961, up to a limit of ₹1.5 lakhs per financial year. Additionally, the death benefit received by your nominee is generally tax-exempt under Section 10(10D) of the Income Tax Act, 1961, subject to fulfillment of specified conditions. These tax benefits effectively reduce the net cost of your comprehensive protection plan. However, tax benefits are subject to changes in tax laws, so it’s advisable to consult your tax advisor for personalized guidance.

How does the Critical Illness coverage work in this plan?

The ABSLI Super Term Plan offers Accelerated Critical Illness (ACI) benefit, which provides a lumpsum payout upon diagnosis of specified critical illnesses. The plan covers up to 42 critical illnesses including cancer, heart attack, stroke, and kidney failure. This benefit is accelerated, meaning it’s paid out from the sum assured, reducing the death benefit accordingly. The payout helps cover treatment costs, manage recovery expenses, and compensate for potential income loss during illness, providing comprehensive financial protection when you need it most.

Secure Your Family’s Future with ABSLI Super Term Plan

The Aditya Birla Sun Life Insurance Super Term Plan represents a significant evolution in term insurance, offering comprehensive protection that addresses multiple financial risks. With its unique combination of life coverage, health protection, and income replacement features, this plan ensures your family remains financially secure against life’s various uncertainties.

Why Choose ABSLI Super Term Plan

- Comprehensive 3-in-1 protection for complete peace of mind

- Flexible plan options to suit your specific needs

- Affordable premiums with special discounts

- High claim settlement ratio for reliable support

- Additional tax benefits to enhance overall value

Take the Next Step

Protect your family’s dreams and aspirations with the ABSLI Super Term Plan. Calculate your coverage needs, explore plan options, and secure your family’s financial future today.

Disclaimer: This article is for informational purposes only. The ABSLI Super Term Plan (UIN: 109N153V01) is underwritten by Aditya Birla Sun Life Insurance Company Limited (ABSLI). This is a non-linked non-participating individual pure risk premium life insurance plan. Tax benefits are subject to changes in tax laws. Please read the sales brochure carefully before concluding a sale. For more details on risk factors, terms and conditions, please read the policy contract available on the ABSLI website.