The world of coin stocks offers diverse investment opportunities spanning traditional minting companies, cryptocurrency exchanges, and rare coin dealers. Whether you’re interested in physical numismatics or digital assets, understanding this unique market segment can unlock significant potential for portfolio growth. This comprehensive guide explores the top coin stocks to watch, compares different investment approaches, and provides actionable strategies to navigate this evolving sector.

What Are Coin Stocks?

Coin stocks represent companies involved in various aspects of the coin industry. These fall into three main categories:

Minting Companies

Businesses that manufacture physical coins, including government mints and private producers. These companies create everything from circulation currency to commemorative and collectible coins.

Cryptocurrency Exchanges

Platforms that facilitate the buying, selling, and trading of digital currencies. These companies provide the infrastructure for cryptocurrency transactions and often offer additional services like staking and custody.

Rare Coin Dealers

Specialized retailers and auction houses that deal in collectible and investment-grade coins. These businesses focus on numismatic value rather than face value, serving collectors and investors in physical coins.

When investors refer to “coin stocks,” they’re typically discussing publicly traded companies in these sectors. The term has gained particular prominence with the rise of cryptocurrency exchanges like Coinbase Global (COIN), which has become one of the most recognized coin stocks on the market.

Top 5 Coin Stocks to Watch in 2024

The coin stock market offers several promising investment opportunities across different segments. Here are the top five coin-related stocks that deserve investor attention in 2024:

1. Coinbase Global, Inc. (COIN)

As the largest cryptocurrency exchange in the United States, Coinbase has established itself as a gateway to the crypto economy. The company provides a trusted platform for retail investors, institutions, and developers to access the cryptocurrency market.

Key highlights:

- Market capitalization of approximately $61.8 billion

- Diversified revenue streams beyond transaction fees

- Strong institutional adoption and custody services

- Expanding into new markets and product offerings

2. CME Group Inc. (CME)

CME Group operates the world’s largest financial derivatives exchange and has been at the forefront of cryptocurrency derivatives. Their Bitcoin futures and options contracts provide institutional investors with regulated exposure to digital assets.

Key highlights:

- Market capitalization of approximately $97.1 billion

- Consistent dividend yield and strong financial performance

- Expanding cryptocurrency derivatives offerings

- Established reputation and regulatory compliance

3. Robinhood Markets, Inc. (HOOD)

Robinhood has transformed retail investing with its commission-free trading platform, which includes cryptocurrency trading capabilities. The company continues to expand its digital asset offerings to meet growing demand from younger investors.

Key highlights:

- Growing user base, particularly among millennial and Gen Z investors

- Expanding cryptocurrency wallet and trading capabilities

- Diversifying revenue streams beyond payment for order flow

- Improving regulatory compliance and security measures

4. MicroStrategy Incorporated (MSTR)

While primarily a business intelligence company, MicroStrategy has become a proxy for Bitcoin investment due to its substantial holdings of the cryptocurrency. The company has adopted Bitcoin as its primary treasury reserve asset.

Key highlights:

- Largest corporate holder of Bitcoin with significant holdings

- Stock performance closely tied to Bitcoin price movements

- Underlying business intelligence software provides stability

- Aggressive Bitcoin acquisition strategy continues

5. A-Mark Precious Metals, Inc. (AMRK)

A-Mark represents the physical coin sector as a leading full-service precious metals trading company. They provide a range of products and services to the wholesale precious metals market, including physical coin distribution.

Key highlights:

- Strong dividend yield compared to other coin stocks

- Benefits from physical precious metals demand during economic uncertainty

- Diversified business model including minting, trading, and storage

- Established relationships with government and private mints

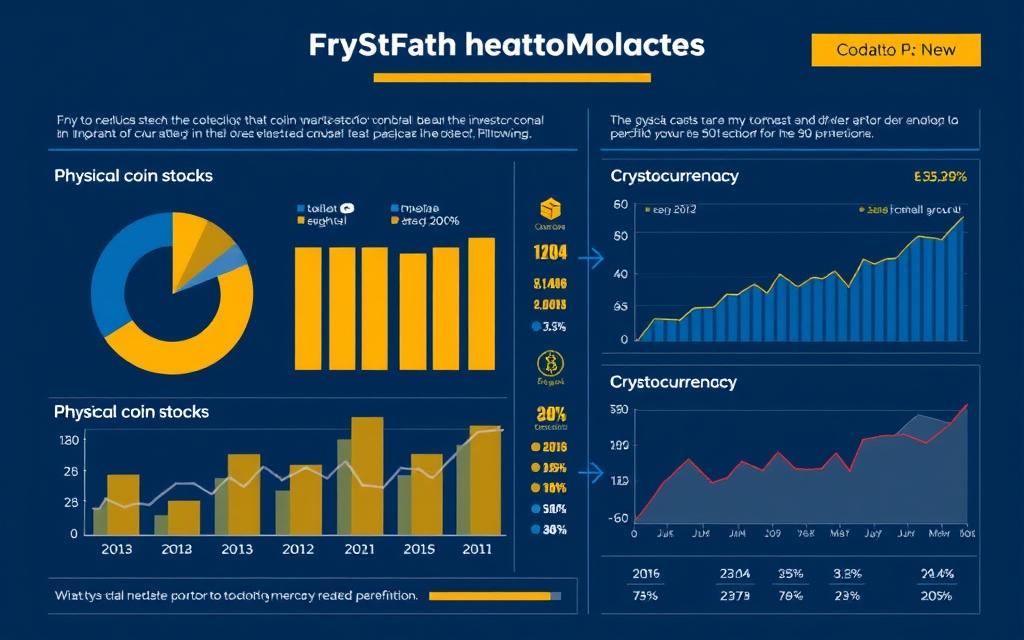

Physical Coin Stocks vs. Cryptocurrency-Related Stocks

The coin stock market encompasses two distinct segments: traditional physical coin companies and cryptocurrency-related businesses. Understanding the differences between these sectors is crucial for developing an effective investment strategy.

Physical Coin Stocks

- Established business models with predictable revenue streams

- Often pay dividends, providing income alongside potential growth

- Less regulatory uncertainty compared to crypto-related stocks

- Performance typically tied to precious metals markets and economic conditions

- Lower volatility with more gradual price movements

Cryptocurrency-Related Stocks

- Higher growth potential with emerging technology and markets

- Greater volatility offering both risk and opportunity

- Performance often correlated with cryptocurrency prices

- Evolving regulatory landscape creates both challenges and opportunities

- Typically focused on growth rather than dividend income

Key Differences in Business Models

Revenue Sources

Physical coin companies generate revenue through manufacturing, distribution, and trading margins. Cryptocurrency companies rely on transaction fees, subscription services, and interest from staking or lending.

Market Influences

Physical coin stocks are influenced by precious metals prices, inflation concerns, and collector demand. Crypto stocks respond to digital asset adoption, technological developments, and regulatory changes.

Growth Trajectories

Physical coin companies typically follow more mature, steady growth patterns. Cryptocurrency companies often experience rapid expansion phases followed by consolidation periods.

Investors should consider their risk tolerance, investment timeline, and portfolio diversification goals when choosing between these two coin stock categories. Many successful investors maintain exposure to both sectors to balance growth potential with stability.

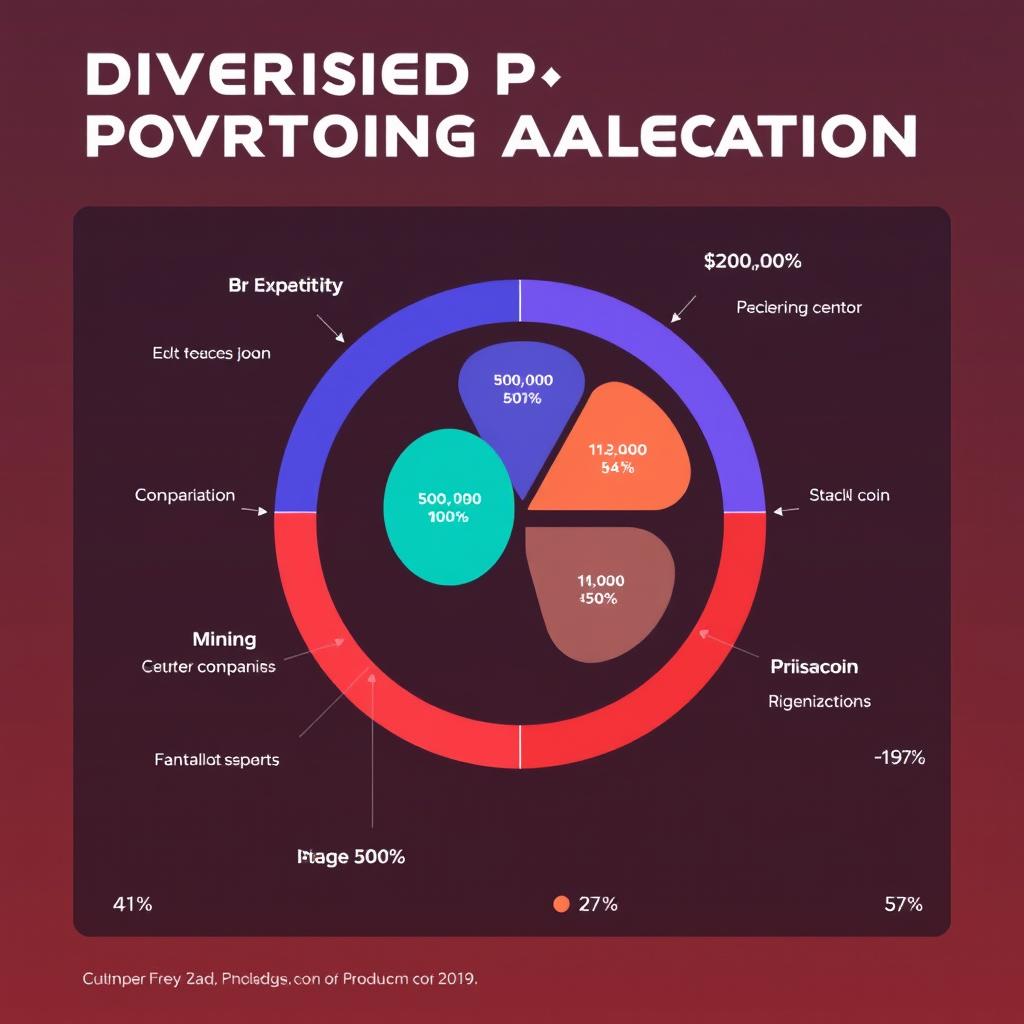

Investment Strategies for Coin Stocks

Developing a sound investment approach for coin stocks requires understanding the unique characteristics of this market segment. Here are proven strategies to consider:

Long-Term Growth Strategy

Focus on companies with strong fundamentals, innovative technology, and expanding market share. This approach minimizes the impact of short-term volatility while capturing the sector’s growth potential.

Diversification Strategy

Spread investments across both physical and cryptocurrency-related coin stocks to balance risk and reward. This approach provides exposure to multiple growth drivers while reducing sector-specific risks.

Momentum Strategy

Capitalize on the volatility of coin stocks by identifying and following price trends. This approach requires active management and technical analysis skills but can generate significant returns during bull markets.

Risk Management Considerations

Effective risk management is essential when investing in coin stocks due to their inherent volatility. Consider these approaches to protect your capital:

- Position Sizing: Limit exposure to any single coin stock to reduce concentration risk

- Stop-Loss Orders: Implement automatic sell triggers to cap potential losses

- Dollar-Cost Averaging: Gradually build positions over time rather than making large one-time investments

- Hedging: Consider options strategies or inverse ETFs to protect against market downturns

- Regular Rebalancing: Periodically adjust your portfolio to maintain your target allocation

“The key to successful coin stock investing is balancing the growth potential of emerging digital asset companies with the stability of established physical coin businesses. This creates a resilient portfolio that can weather market cycles while capturing long-term value.”

Case Study: Successful Coin Stock Investment

Examining real-world success stories provides valuable insights into effective coin stock investment approaches. The following case study highlights key lessons from a successful investment in Coinbase Global (COIN).

Investment Timeline: Coinbase Global (COIN)

Initial Investment

After Coinbase’s direct listing in April 2021, the stock experienced significant volatility. Strategic investors who accumulated positions during price corrections in mid-2021 when the stock traded below $225 established favorable entry points.

Growth Catalysts

Several factors drove COIN’s subsequent performance: institutional adoption of cryptocurrencies, expansion of product offerings beyond trading fees, regulatory clarity developments, and the company’s addition to major indices like the S&P 500.

Results and Lessons

Investors who maintained positions through market volatility saw significant returns as the stock reached new highs. The key lesson: focusing on the company’s fundamentals rather than short-term price movements yielded superior results.

Key Success Factors

- Entering positions during periods of market pessimism rather than euphoria

- Focusing on the company’s expanding ecosystem beyond core trading services

- Maintaining conviction through cryptocurrency market cycles

- Recognizing the long-term trend of institutional cryptocurrency adoption

This case study demonstrates that successful coin stock investing often requires a contrarian mindset, thorough understanding of the underlying business model, and patience to allow growth catalysts to materialize. While past performance doesn’t guarantee future results, these principles remain relevant for current coin stock opportunities.

Future Market Trends in Coin Stocks

The coin stock market continues to evolve rapidly, influenced by technological innovation, regulatory developments, and changing investor preferences. Understanding emerging trends can help identify future investment opportunities.

Emerging Developments to Watch

Central Bank Digital Currencies (CBDCs)

As governments worldwide develop their own digital currencies, companies providing the infrastructure, security, and exchange services for CBDCs stand to benefit significantly. This represents a convergence of traditional finance and blockchain technology.

Tokenized Securities

The trend toward tokenizing traditional assets, including stocks, bonds, and real estate, creates new opportunities for coin stock companies that facilitate these markets. This expands the addressable market beyond cryptocurrencies.

Institutional Adoption

Continued integration of digital assets into traditional financial systems will drive growth for established coin stocks. Companies that bridge the gap between conventional finance and cryptocurrency markets are particularly well-positioned.

Collectible Coin Market Evolution

The physical collectible coin market is also experiencing transformation:

- Digital Authentication: Blockchain technology is increasingly used to verify provenance and ownership of rare coins

- Online Marketplaces: Traditional auction houses and dealers are expanding their digital presence

- Fractional Ownership: New platforms allow investors to purchase shares of high-value numismatic items

- NFT Integration: Some physical coin producers are creating digital twins as non-fungible tokens

Regulatory Considerations

The regulatory landscape for coin stocks continues to evolve globally. Companies that proactively address compliance requirements while advocating for innovation-friendly frameworks will likely outperform. Investors should monitor regulatory developments in key markets, particularly the United States, European Union, and Asia.

These trends suggest that the distinction between traditional financial services and cryptocurrency markets will continue to blur. Companies that successfully navigate this convergence while maintaining strong fundamentals are likely to deliver superior long-term returns for investors.

Conclusion: Building a Balanced Coin Stock Portfolio

Investing in coin stocks offers exposure to both established markets and emerging technologies. The sector encompasses traditional physical coin companies with stable business models as well as innovative cryptocurrency firms with significant growth potential. By understanding the unique characteristics of each segment and implementing appropriate investment strategies, investors can build portfolios that balance risk and reward.

Whether you’re interested in the stability of physical coin stocks or the growth potential of cryptocurrency exchanges, this diverse market segment provides opportunities for various investment approaches. As with any investment, thorough research, risk management, and a long-term perspective are essential for success in the evolving world of coin stocks.

Ready to Explore Coin Stock Investments?

Get access to professional research tools, real-time market data, and expert analysis to make informed investment decisions.

| Company | Ticker | Market Cap (B) | Dividend Yield | 5-Year Growth Projection | Primary Sector |

| Coinbase Global | COIN | $61.8 | – | 43.3% | Cryptocurrency Exchange |

| CME Group | CME | $97.1 | 2.3% | 8.5% | Financial Derivatives |

| Robinhood Markets | HOOD | $17.2 | – | 16.7% | Retail Trading Platform |

| MicroStrategy | MSTR | $14.5 | – | 10.0% | Business Intelligence/Bitcoin |

| A-Mark Precious Metals | AMRK | $0.8 | 2.1% | 5.2% | Physical Precious Metals |

Get Expert Analysis on Coin Stocks

Receive professional insights, technical analysis, and investment recommendations tailored to your financial goals.

Create Your Personalized Investment Strategy

Get a customized coin stock investment plan based on your financial goals, risk tolerance, and timeline.

| Market Segment | Current Market Size | 5-Year Projected Growth | Key Growth Drivers | Investment Implications |

| Cryptocurrency Exchanges | $27.8B | 18.2% CAGR | Institutional adoption, retail investor expansion, new asset listings | Focus on exchanges with strong security, regulatory compliance, and diverse revenue streams |

| Blockchain Infrastructure | $15.2B | 24.5% CAGR | Enterprise blockchain adoption, interoperability solutions, scaling technologies | Look for companies providing essential infrastructure rather than speculative applications |

| Physical Precious Metal Coins | $12.4B | 6.8% CAGR | Inflation hedging, wealth preservation, collector demand | Consider companies with diversified business models spanning minting, distribution, and storage |

| Tokenized Securities | $4.6B | 32.7% CAGR | Regulatory clarity, institutional demand, efficiency improvements | Early-stage opportunity with significant growth potential as adoption increases |

| Numismatic Collectibles | $8.2B | 4.3% CAGR | Digital marketplace expansion, authentication technology, new collector demographics | Focus on companies embracing digital transformation of the collector market |

Stay Ahead of Coin Stock Market Trends

Receive regular updates, market analysis, and investment ideas delivered directly to your inbox.

What is the difference between investing in coin stocks and directly in cryptocurrencies?

Investing in coin stocks means purchasing shares of companies involved in the coin industry (like Coinbase or CME Group), while investing directly in cryptocurrencies involves buying the digital assets themselves (like Bitcoin or Ethereum). Coin stocks offer exposure to the sector through regulated securities with traditional corporate structures, financial reporting, and potential dividends. They may be less volatile than direct cryptocurrency investments while still providing exposure to the sector’s growth.

Are coin stocks suitable for retirement accounts?

Publicly traded coin stocks can be included in retirement accounts like IRAs and 401(k)s, unlike most direct cryptocurrency investments. However, due to their volatility, they should typically represent only a portion of a diversified retirement portfolio. Consider your investment timeline, risk tolerance, and overall financial goals when determining the appropriate allocation to coin stocks within retirement accounts.

How do regulatory changes affect coin stock investments?

Regulatory developments can significantly impact coin stocks, particularly those in the cryptocurrency sector. Favorable regulations that provide clarity while allowing innovation typically benefit these companies, while restrictive regulations may create challenges. Physical coin companies generally face less regulatory uncertainty. Investors should monitor regulatory trends in key markets and consider how different companies are positioned to adapt to changing requirements.

Ready to Invest in Coin Stocks?

Start building your portfolio with professional guidance and research tools designed for coin stock investors.

[Infographic: Comparison of market capitalization and growth potential between physical coin stocks and cryptocurrency-related stocks]

[Infographic: Risk-reward analysis of different coin stock investment strategies with volatility metrics]

[Infographic: Future growth projections for different segments of the coin stock market through 2030]